Event: Craps Don’t Pass Day 2/3 (February 3rd)

Walk into a casino and you will hear loud and rambunctious gamblers at the Craps table. They are betting with the dice and against the casino. The more numbers they hit the more money they make … as long as they stay away from rolling a SEVEN. Once a point is established, rolling a seven will end the round and the casino will take down all of the bets. Game over! That is unless you bet against the dice and with the casino. This means playing the Don’t Pass Line … much like a contrarian investor betting against the crowd.

In Craps it all begins with the Come Out roll. You can either bet with or against the dice. The Don’t Pass line pays the gambler when a 2 or 3 is rolled on the come out. If a seven is rolled on the come out … then the Don’t Pass line better will lose. This may seem like bad odds, but once a point is established, the odds switch to the Don’t Pass line better because if a SEVEN is rolled they get paid. Want to learn more about Craps? Here is a resource guide that translates trading concepts into playing Craps. [Craps Explained]

Seven Out! Pay the Don’ts … let’s see if the days leading up to Craps Don’t Pass Day on February 3rd are bullish or bearish for the futures markets.

Market Comparision

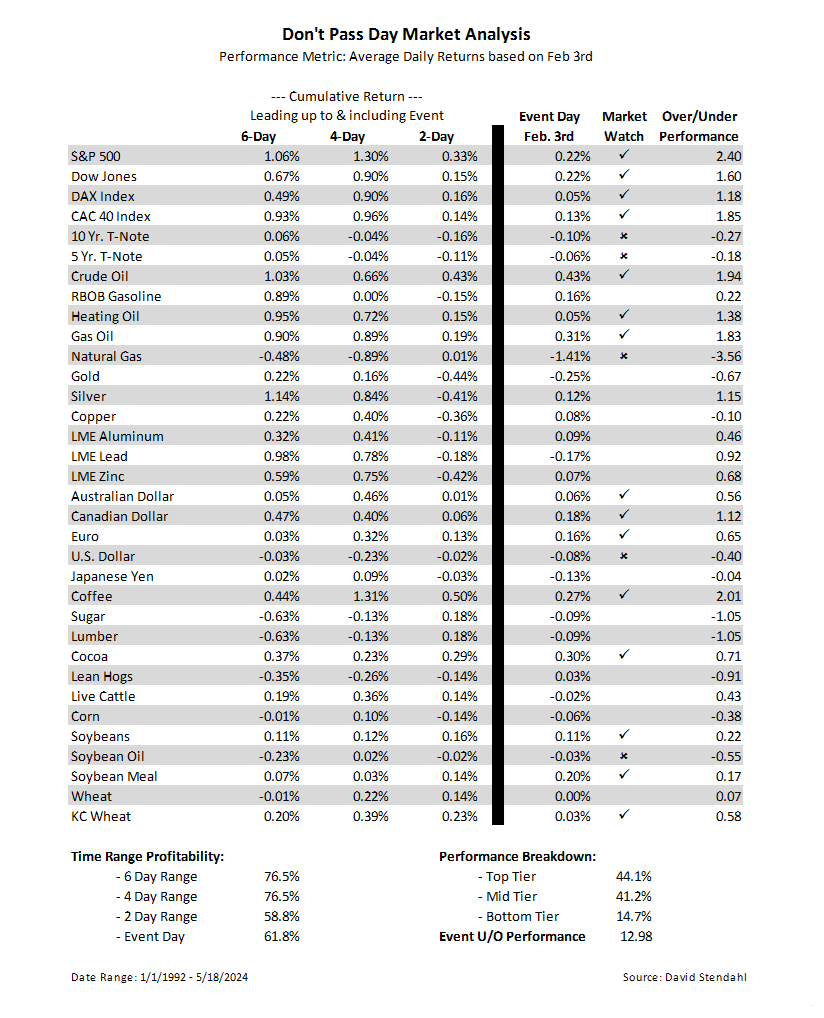

How do the markets perform leading up to and including Craps Don’t Pass Day? The analysis table below breaks down each of the 30+ markets into four separate trading periods. These time frames span 6-days, 4-day, 2-days, and the event day itself. The return performance for each time frame is measured against its normal performance during the year to calculate a final over or underperformance return. This metric quantifies, in percentage points, the advantages or disadvantages associated with Craps Don’t Pass Day in early February. Markets highlighted with a checkmark or an “x” should be closely monitored for potential strength or weakness heading into the event.

Bonus Analytics: For complete analysis check out the performance of the markets leading up to Craps Day

Calendar Breakdown by Events

All trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results.

Our strategies have not been developed based on knowledge of or with reference to your particular circumstances, such as financial position, goals, risk-reward preferences, tax situation, brokerage arrangement, investment or trading experience, and so forth. Hence no content or model published here constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal financial situation. More