Tide Level

When it comes to trading markets, trends are constantly in flux, and momentum can be unpredictable. That’s why having the right tool for recognizing changes is so important. Enter the Tide Level indicator: your go-to resource for spotting upswings (bullish trends) or downturns (bearish trends). With this invaluable guide, you’ll be able to identify when a trend is ready to take action … and know which Signal Central trading systems to put into play!

With the Tide Level indicator, traders can get an insight into market sentiment and identify potential opportunities. For example, if buyers are in control, prices will go up – but if sellers dominate, they’ll likely be heading down. Either way, the Tide Level indicators will generate an alert to the opportunity that a strong trend is likely to form. Thus allowing traders to activate trading systems that can exploit emerging trending phases. The Tide Level indicator is also a valuable tool for managing risk. It helps traders recognize when markets are in danger of reversing direction and adjust their positions accordingly. By using the indicator to anticipate potential reversals, traders can stay ahead of the curve and avoid making costly mistakes.

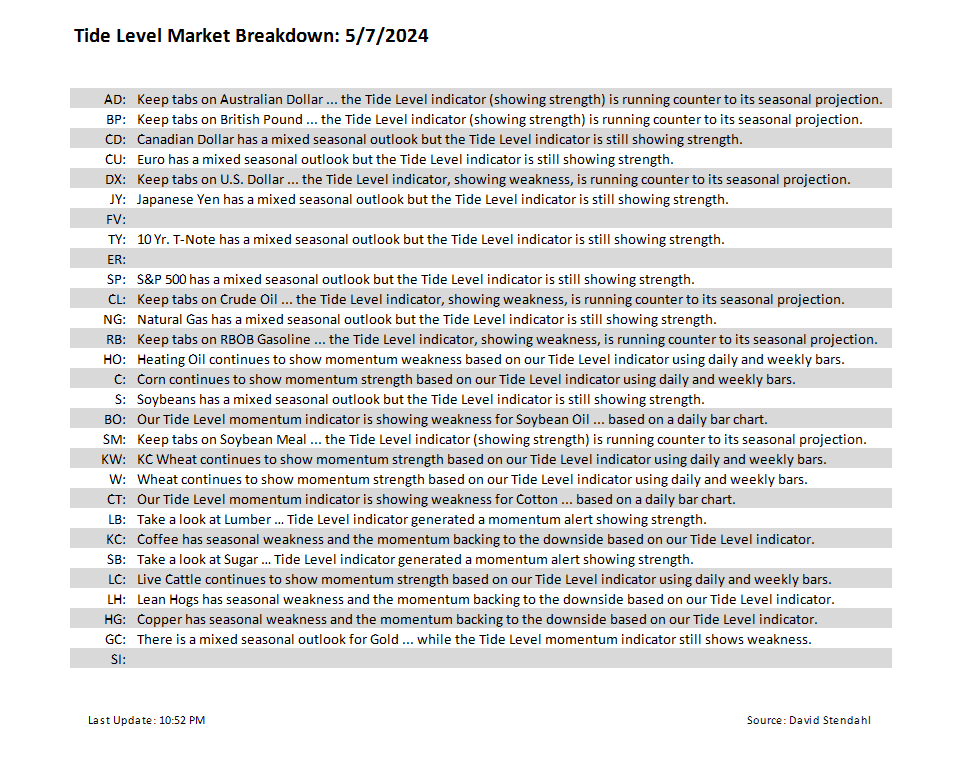

Tide Level in action …

The Tide Level indicator can provide helpful guidance to traders, so they know which markets/trading systems offer the greatest potential opportunity. The alerts make it easy for traders to stay up-to-date on the latest market environment, directing them when to activate, alter leverage or simply follow the systems as designed.

- New: Activate the trading system. Allow the system the opportunity to enter into a trade. If the system is already in a position, it’s best to wait for the next trading situation.

- Continuation: Maintain active positions based on the trading plan.

- Seasonal Continuation: Strong trends are potential; consider adding to positions if the seasonal outlook confirms the trend.

- Deleverage: Possible top or bottom indication; consider deleveraging if the alert is running counter to the trading position.

- Blank: No market opinion.

Dig deeper from a YTD perspective ...

All trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results.

Our strategies have not been developed based on knowledge of or with reference to your particular circumstances, such as financial position, goals, risk-reward preferences, tax situation, brokerage arrangement, investment or trading experience, and so forth. Hence no content or model published here constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal financial situation. More