Market Comparison Breakdown: Fib Sequence Day vs Fib Ratio Day

Italian Leonardo of Pisa, better known by his nickname Fibonacci, was perhaps the most talented Western mathematician of the Middle Ages. In 1202 he wrote a book called “Liber Abaci” (“Book of Calculation”), in which he promoted the use of the Hindu-Arabic numeral system over Roman numerals then in use in Europe.

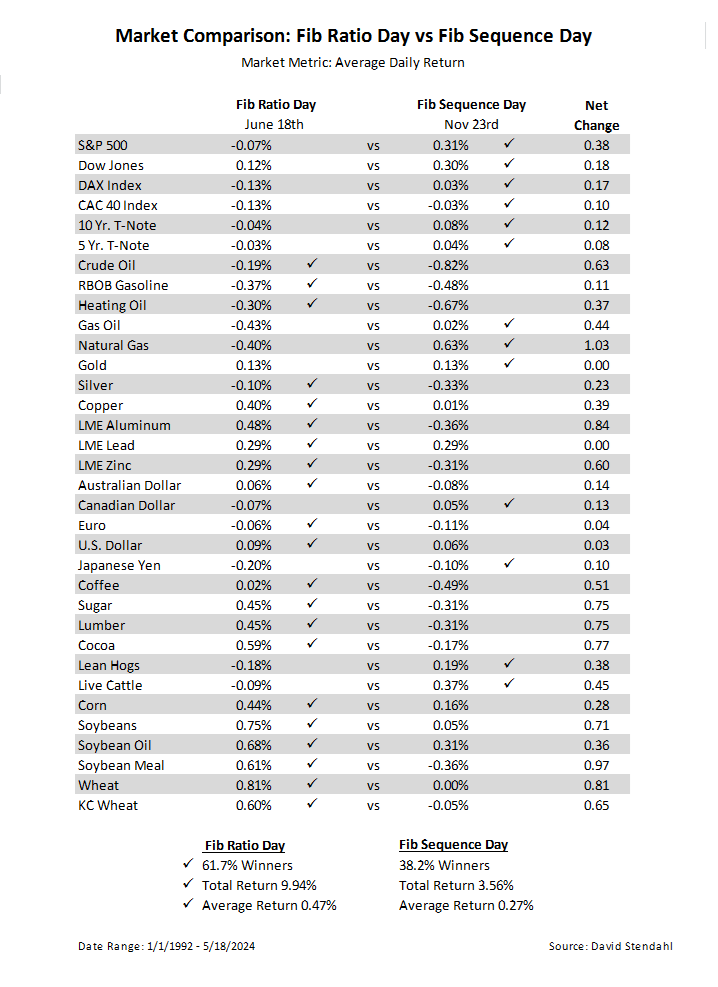

Fibonacci is best known for his introduction into Europe of a particular number sequence, which has since become known as Fibonacci Numbers or the Fibonacci Sequence. Fibonacci numbers form a sequence where a number is the sum total of the last two numbers, starting with 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55 … and so forth. When we take any two successive Fibonacci numbers, their ratio is very close to 1.618, or its inverse 0.618. This ratio can be seen throughout nature and even finds its way into trading. As Fibonacci is all about numbers we thought that we would test (just for fun) the influence that may or may not affect the markets on the two Fibonacci dates; Fibonacci Sequence Day on November 23rd and Fibonacci Ratio Day on June 18th. Click on the links to discover why these dates celebrate Leonardo of Pisa (AKA Fibonacci).

The questions is which Fibonacci date influences the markets the most … Sequence or Ratio?

Calendar Breakdown by Events

All trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results.

Our strategies have not been developed based on knowledge of or with reference to your particular circumstances, such as financial position, goals, risk-reward preferences, tax situation, brokerage arrangement, investment or trading experience, and so forth. Hence no content or model published here constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal financial situation. More