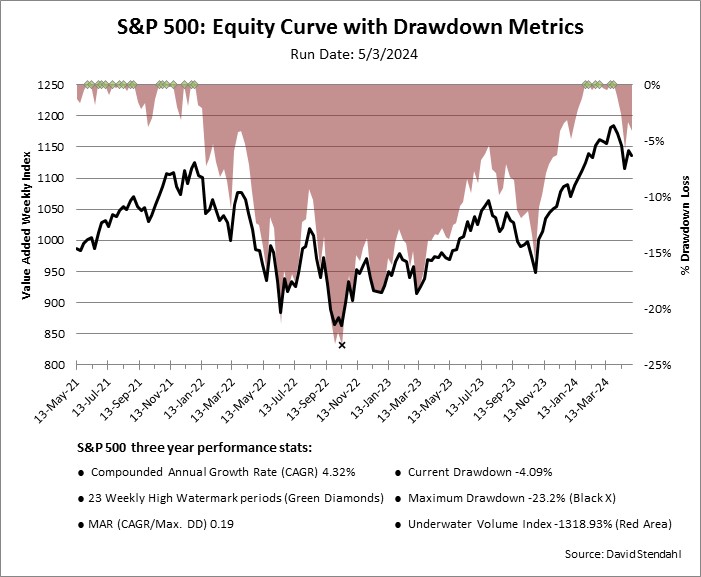

Weekly Underwater Volume Index: S&P 500 Index (SP)

Risk can be defined in many ways … the S&P 500 Index chart below focuses on a variety of drawdown risk measures that provide prospective on past risk and potential opportunity. The S&P 500 Index, shown as a black line, is calculated using the Value Added Weekly Index (VAWI) method. The VAWI line assumes an initial $1,000 is invested in the market. Over time, weekly percent returns are summarized to show performance (i.e. an equity curve) over a three year time period. It should be noted that in the futures markets, we can’t invest exact amounts because we cannot trade fractional contract, so the VAWI line provides direction but not actual price levels for the market. The VAWI method does however provide an advantage as it normalizes performance which allows us to evaluate a variety of futures markets all on the same scale.

Drawdown Definitions

- Current Drawdown: Open loss since last underwater equity high.

- Maximum Drawdown: Largest peak-to-valley loss.

- Underwater Volume Index: Accumulation of all drawdown periods.

- MAR: A ratio that compares Reward, defined as Compounded Annual Growth Rate (CAGR) to Risk, defined as Maximum Drawdown.

Three Year Underwater Volume Index: