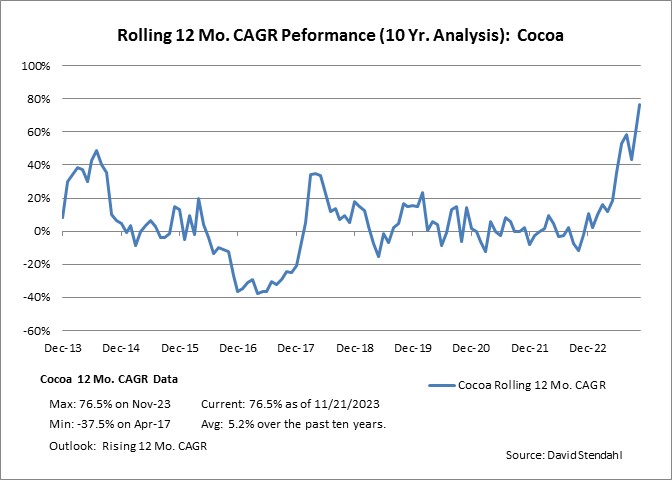

Rolling 12 Month CAGR: Cocoa

Rolling CAGR Profile:

The rolling Compounded Annual Growth Rate (CAGR) analysis provides a historical perspective of a market’s return over time. CAGR is a measure of reward. By itself, it only measures performance over a single period, but our rolling ten-year analysis takes 120 performance snapshots with each data point calculated based on a 12-month Compounded Annual Growth Rate. The data is then combined to show how CAGR return performance changes over time.

Overview:

If a market’s current 12-month CAGR return stands at 10%, is that good or bad performance? That question can’t be properly answered because we are missing perspective. The rolling CAGR chart allows us to see if the market’s current CAGR return is historically high, average, or even low. The rolling analysis also reveals when a market has had its biggest moves. If the market should find itself in a similar bullish or bearish environment going forward, the rolling Compounded Annual Growth Rate chart could provide perspective for the market’s potential. The rolling CAGR chart does its job by adding clarity around a market’s performance.

Rolling 12 Month CAGR Performance: Cocoa

Sector Comparison

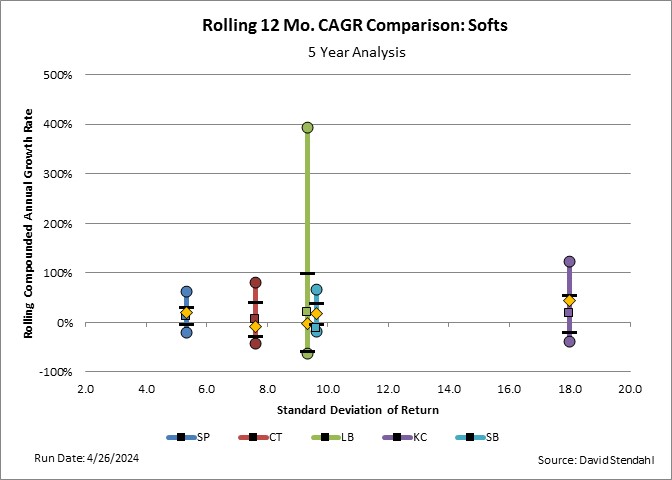

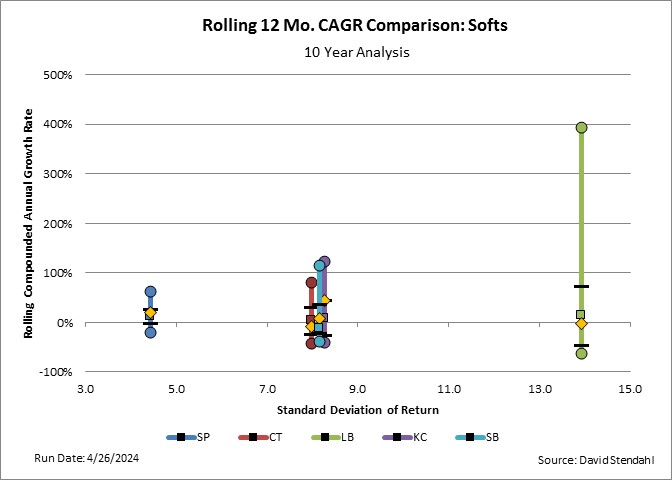

Take a look at how the Rolling CAGR for the Cocoa (CC) compares with other Soft markets. We offer two sector comparison time frames: a shorter five year and a longer ten year period.

Click on the links or either of the two charts for greater detail.