Rolling 12 Month CAGR Overview: Ten Year Analysis

A market’s 12 Month Compounded Annual Growth Rate (CAGR) tells us how a market has performed over the recent past. It fails however, to provide any degree of perspective over time. If a market generates a 12% CAGR in a year is that good or bad? Some might say any positive return is good. That unfortunately is a little to simplistic. A 12% CAGR return for the Eurodollar market would be fantastic … but the same 12% return for Sugar might be considered sub par. Historic perspective is the name of the game when it comes to comparing performance.

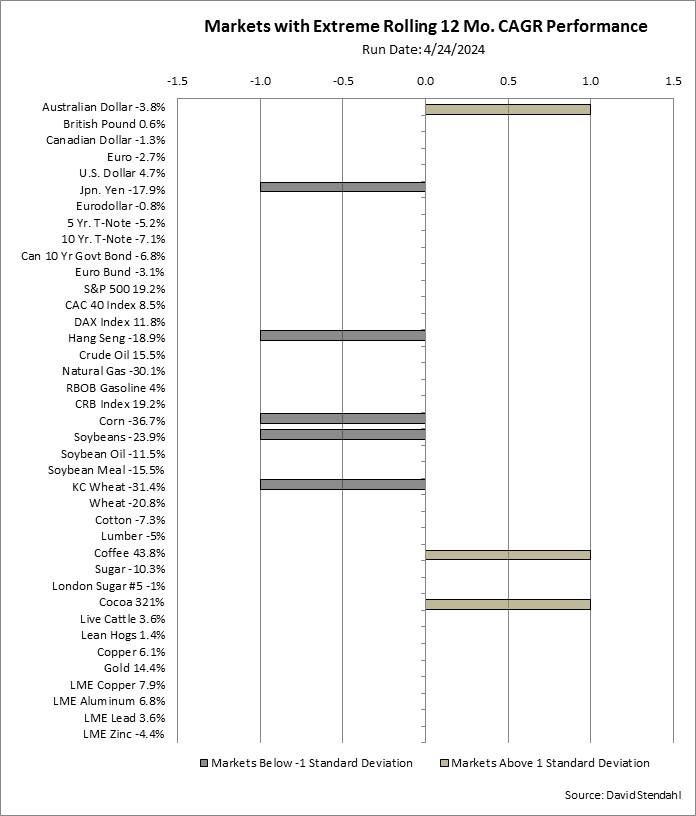

Markets with Extreme Rolling 12 Month Compounded Annual Growth Rate Performance