Webinar Series: Market Analytics

Series Part One: Market Expansion / Contraction

Description

All markets cycle through hot and cold phases. The key is to identify which phase the market is in so that you can implement the appropriate trading plan for the correct environment.

This webinar focuses on the Energy Level indicator as it measures if a market is in a cold contraction or hot expansion phase. Markets that are in a contraction phase are candidates for breakouts and likely to establish new trends. On the other hand, markets that are in an expansion phase will focus on explosive moves and unwinding positions with well deserved profits.

Webinar Topics

- Trend Origins

- BO/BD Candidates

- Profit Taking Opportunities

- Energy Level Introduction

- Dynamic Volatility

- Trade management

Series Part Two: Identifying Trend Phases

Description

The Trend may be your friend … but not all trends are created equal. The key is to identify which trend phase you are in so that you can implement the appropriate trading plan for the correct environment.

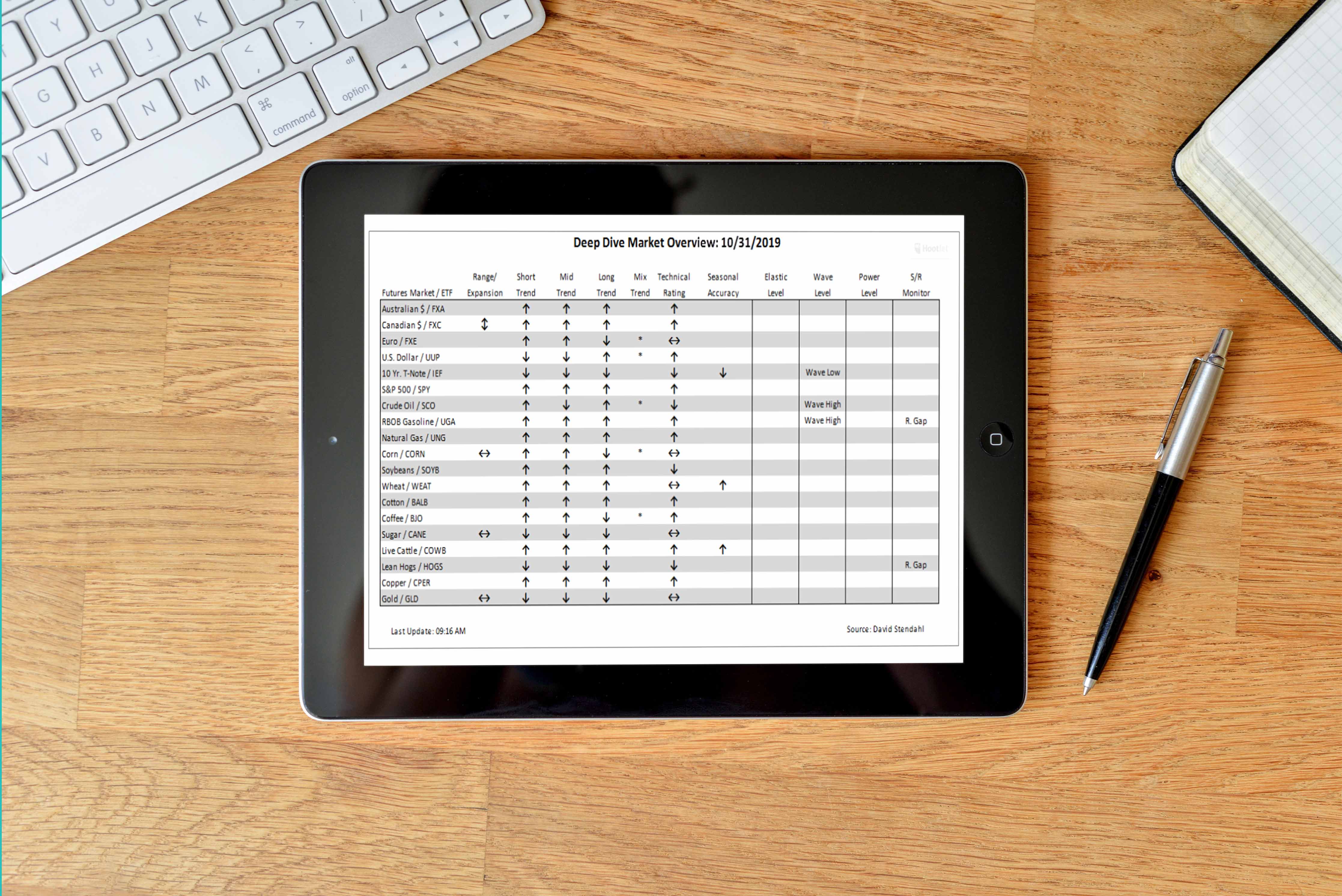

This webinar will focus on identifying various trend phases in conjunction with other Deep Dive analytic indicators to help traders take full advantage of market conditions.

Webinar Topics

- Trend Time Frames

- Mixed Trend Opportunities

- Normal, Expansive & Parabolic Trends

- Wave Level Indicator

- Power Level Indicator

- Rocket & Sub Alerts

Series Part Three: Technical Ratings for Enhanced Trade Analysis

Description

The technical strength surrounding a market can influence the continuation of a trend or signify an impending market reversal. So, staying on the correct side of the market and fully exploiting potential moves needs to be a part of any successful trading plan. Our technical rating indicator measures the technical strength of a market. It provides a directional rating for a market, indicating if it has upside, downside or a natural bias. The technical rating combines 30+ trading alerts into a single indicator.

Webinar Topics

- Technical Rating Bullish, Bearish or Neutral

- Watch List Summary

- Technical Indicator Alerts

- Pro Alert Overview

- Profit Taking Alerts

- Reversal Alerts

- Environmental Alerts

Series Part Four: Dynamic Trading Indicators

Description

The definition of over bought and oversold is relative to the markets trading environment. What is extreme in one market phase may not be in a different phase. Momentum indicators need to adjust and adapt to any trading environment. More importantly we need a variety of dynamic momentum indicators to fully evaluate if a market is likely to reverse course. In this webinar we review three dynamic indicators and discuss how they evolve over time to accurately measure over bought and oversold conditions.

Webinar Topics

- Detrend Indicator

- Dynamic OB/OS Advantage

- Elastic Levels

- Bear Surge & Bull Dips

- MA Elastic Lows and Highs

Series Part Five: Measuring Support and Resistance levels

Description

Support and resistance levels are critically import when evaluating the markets. They provide price targets and potential reversal points important in any trading plan. Unfortunately, all support and resistance levels are not created equal. This webinar will use Signal Levels to identify key levels worth watching. Additionally, we will measure their strength relative to other levels across time frames to highlight the strongest price target.

Webinar Topics

- Identifying Support Resistance Levels

- Signal Level Overview

- Measuring S/R Strength

- Market Targets

- Trading with Signal Levels

Series Part Six: Trading with Seasonal Trends

Description

The trend may be your friend but a seasonal trend is your best friend. In this webinar we will review how to identify seasonal trends to allow traders to focus attention and capital on markets ready to move. We will cover a wide variety of markets, highlighting situations to improve trade selection in both bullish and bearish periods.

Webinar Topics

- Focus on market on the Seasonal Top Ten list

- Evaluate markets with seasonal accuracy correlations

- Provide a 21-day price projection for markets that offer the best trading opportunities.

- Best practices for incorporating seasonal trading process into your daily analysis.

Series Part Seven: Profit-Taking Pro Alerts

Description

When you have an open position profit, sometimes your emotions can negatively influence when you take profits. This webinar focuses on alerts that help traders recognize appropriate profit-taking opportunities based on price action, not gut feel. Specifically, you will learn how to incorporate the Surge, Doubt and Flow profit talking Pro Alerts into your personal trading plan.

Webinar Topics

- Review various profit-taking alerts designed for different trading environments.

- Highlight markets that have moved too far and too fast offering situations to unwind positions while in a market surge.

- Recognize markets that are slowly rolling over and presenting potentially last opportunities to take profits.

- Identify markets that are likely to re-establish existing trends while providing conditions to exit counter-trend trades.

- Learn to use these profit-taking Pro Alerts to help design a consistent and disciplined trading plan devoid of emotions.

Series Part Eight: Opportunity List

Description

Identify markets with above average trading opportunity. In this webinar we focus on markets that fall into three opportunity classifications; Opposing Forces, Quiet Phase and Pent-up Energy. Markets that fall into these classifications need to be closely monitored as it’s only a matter of time before trading opportunities present themselves. When opportunity knocks … be prepared!

Webinar Topics

- Focus on market above average trading opportunity

- Spells out the Deep Dive analysis in an easy to follow format

- Additional content can be found in the Market Observation table.

Presenter: David Stendahl

David Stend ahl is founder and president of Signal Trading Group, an international speaker and the author of three books. He has designed trend, pattern and momentum style trading systems for more than 20 years. He focuses on trading the global futures markets, following a systematic, low leveraged and highly-diversified trading regiment. More about David

ahl is founder and president of Signal Trading Group, an international speaker and the author of three books. He has designed trend, pattern and momentum style trading systems for more than 20 years. He focuses on trading the global futures markets, following a systematic, low leveraged and highly-diversified trading regiment. More about David