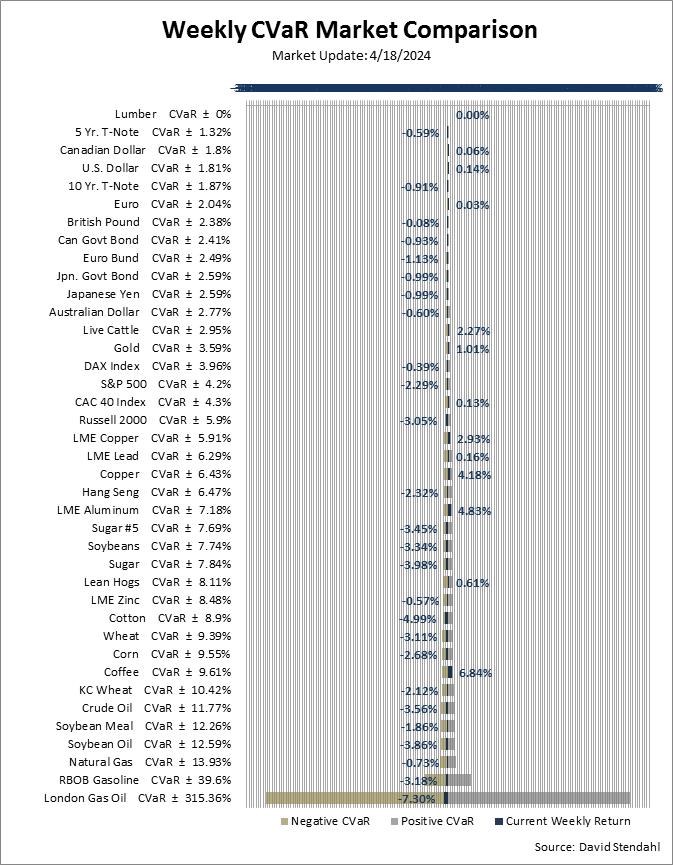

Weekly CVaR Comparison

Conditional Value at Risk (CVaR) is a statistical measure portfolio managers use to define risk. In the case of CVaR, if it’s broken, something major has occurred in the market. If the market should hit ±CVaR, it will either find a point of consolidation or accelerate even further in the same direction. In trading terms, it’s a decision point – do you exit or add to positions?

Additionally, individuals new to trading should also look at CVaR as a reference point to determine if they can handle the risks associated with being on the wrong side of a strong market. [More]

Weekly CVaR Comparisonn

CVaR Definition:

Conditional Value at Risk was created to be an extension of Value at Risk (VaR). The VaR model does allow managers to limit the likelihood of incurring losses caused by certain types of risk – but not all risks. The problem with relying solely on the VaR model is that the scope of risk assessed is limited, since the tail end of the distribution of loss is not typically assessed. Therefore, if losses are incurred, the amount of the losses will be substantial in value.

A risk assessment technique often used to reduce the probability a portfolio will incur large losses. This is performed by assessing the likelihood (at a specific confidence level) that a specific loss will exceed the value at risk. Mathematically speaking, CVaR is derived by taking a weighted average between the value at risk and losses exceeding the value at risk – Investopedia