Market Comparison Breakdown: Moon Phase

The moon orbits around the Earth every 27.3 days and it takes 29.5 days to complete a lunar phase cycle, meaning new moon to new moon phase. The phases of the moon changes depending on where the moon is in its rotation around the earth and relative to the sun. Let’s review the four main phases of the moon; the new moon, first 1/4 moon, full moon, and last 1/4 moon.

- A new moon is when the sun and the moon are on the same side of the Earth. Because the sun is not facing the moon, from our perspective on Earth, it looks like the dark side of the moon is facing us.

- The moon reaches the first quarter a week after the new moon. It’s called the first quarter because, at that point, the moon is one-quarter of the way through its monthly cycle of phases.

- A full moon occurs when the sun and the moon are on opposite sides of the Earth. Because the sun is direct across from the moon, the light completely illuminates it, making the moon appear completely full on Earth.

- The last quarter moon is the reverse process of the first quarter, making its way back to another new moon.

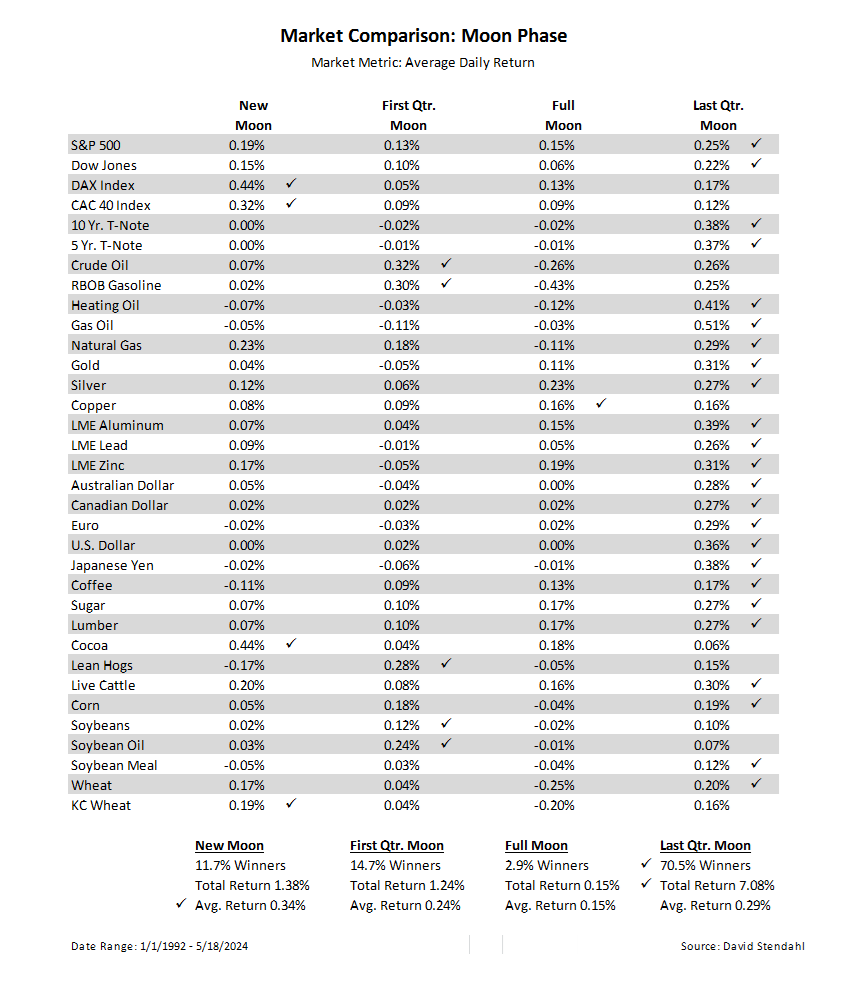

The question is … How do the markets perform relative to the four major moon phases?

Calendar Breakdown by Events

All trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results.

Our strategies have not been developed based on knowledge of or with reference to your particular circumstances, such as financial position, goals, risk-reward preferences, tax situation, brokerage arrangement, investment or trading experience, and so forth. Hence no content or model published here constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal financial situation. More