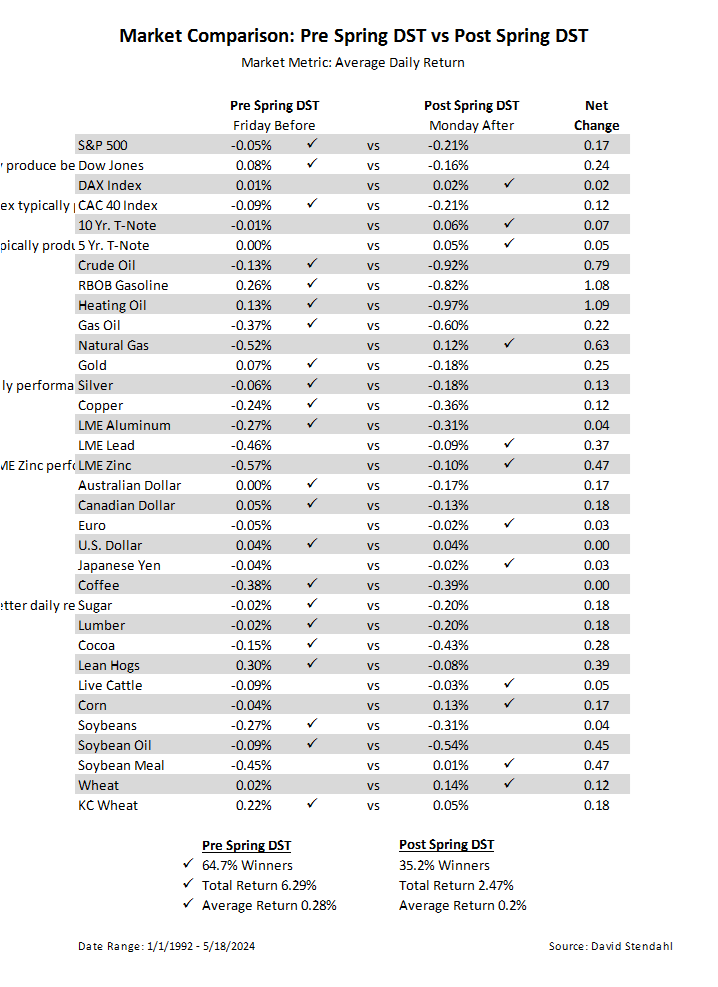

Market Comparison Breakdown: Spring DST Before and After

When daylight saving time arrives on the second Sunday in March, it means we are going to spring forward and lose a precious hour of sleep. Losing one hour on the clock does mean that we will gain additional sunlight over the coming months … but in the short term, most will experience some degree of grogginess. Can the same be said about 30+ global futures markets?

The question is … How do the markets react pre/post to Spring Daylight Saving Time?

Calendar Breakdown by Events

All trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results.

Our strategies have not been developed based on knowledge of or with reference to your particular circumstances, such as financial position, goals, risk-reward preferences, tax situation, brokerage arrangement, investment or trading experience, and so forth. Hence no content or model published here constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal financial situation. More