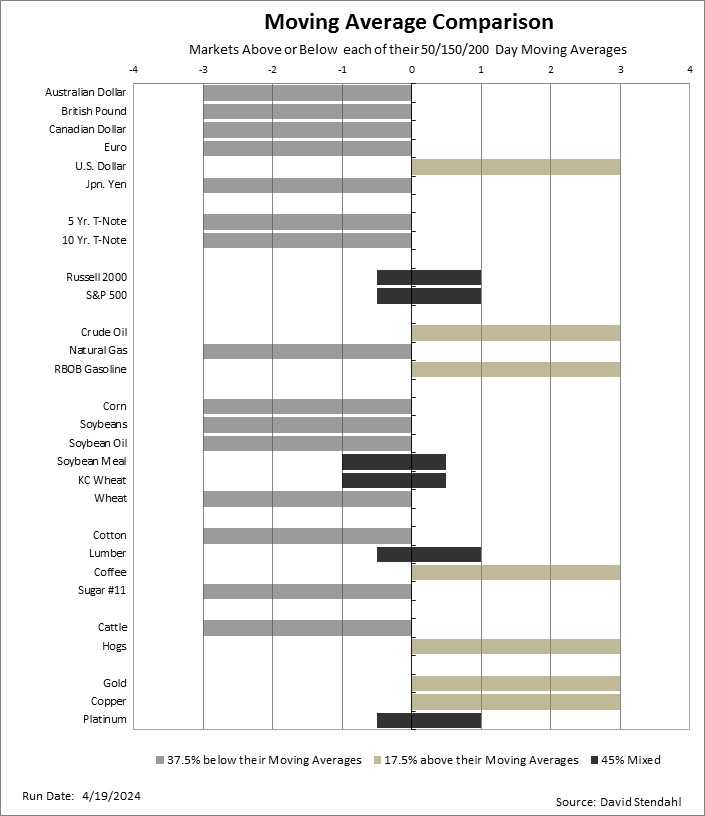

50/150/200 Day Moving Average Cross Comparison

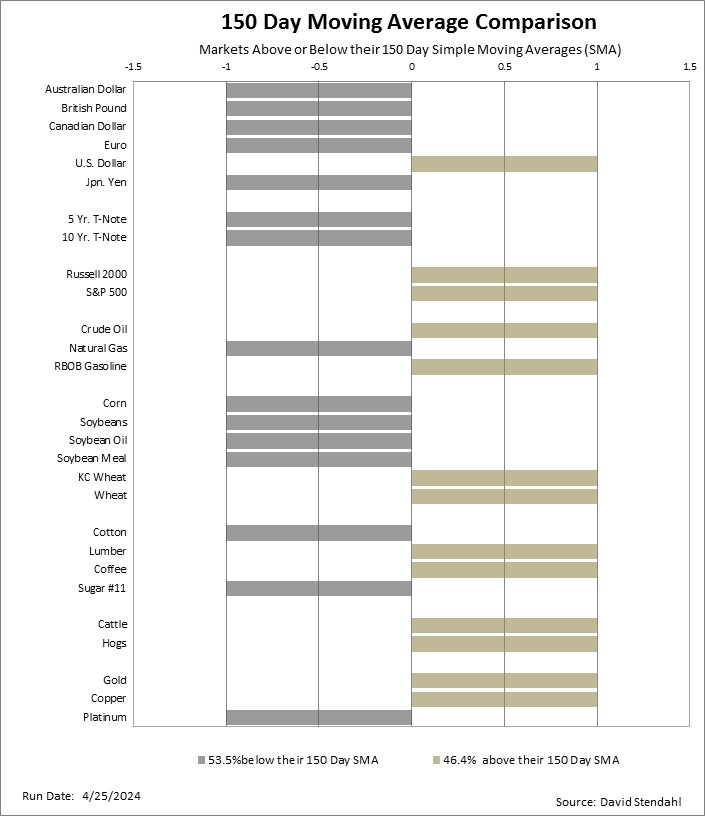

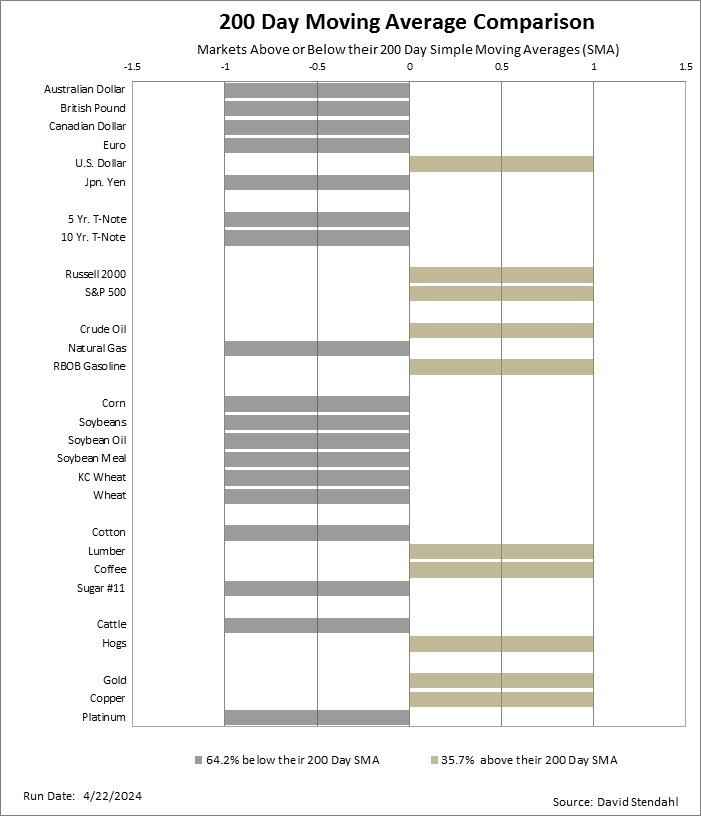

Moving averages provide “perspective’ to the general direction of a market. Yes … they are slow but they can keep you grounded and focused on the correct side of a bull or bear phase. The main chart, Multiple SMA, summarizes the phase for three separate simple moving averages for a variety of futures markets. Markets that are above their 50, 150 and 200 day moving averages appear in tan (pointed right) while those that are below all three moving averages appear in grey (pointed left). Market with mixed moving averages appear in black with a biased to the bull side (right) or bear side (left). The other three charts breakdown the specific phase for each of the 50/150/200 day moving averages.

50/150/200 Day Moving Average Market Cross Comparison: