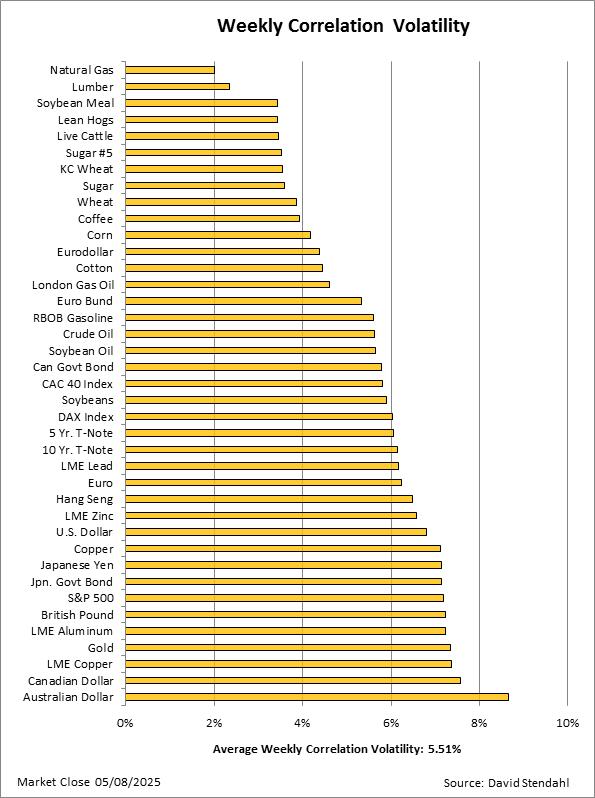

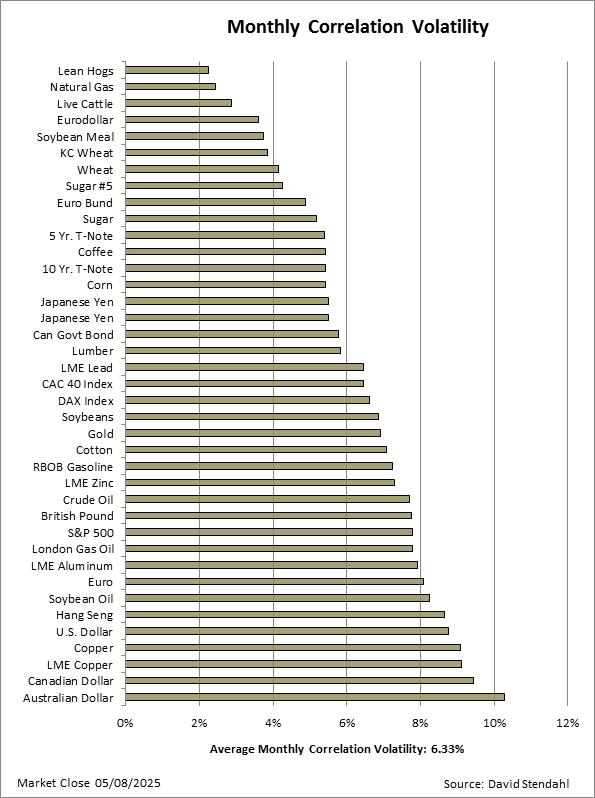

Correlation Volatility

Correlations between markets can run together while for other market pairs they move in opposite directions. Additionally these correlations may be highly volatile changing dramatically while for other market pairs there correlations can remain steady for extended periods of time. Point is correlations between markets change all the time. For a complete review of our rolling correlation analysis for all market pairs click on our Weekly or Monthly breakdowns.

The next step …

The Correlation Volatility charts below take our correlation analysis a step further. Instead of looking at market pairs; the Correlation Volatility reviews a single markets against 39 other futures markets spread across eight separate sectors. The analysis focuses on correlation stability across a large basket of markets. Markets that offer stable (low volatility) near-zero correlations against the vast majority of other markets will have a low volatility number and appear at the top of the list. Markets with correlations that are highly volatile and well away from near-zero levels on average will have a high volatility number and appear at the bottom of the ranking.

Looking for a new market with stable near-zero correlations to add into your portfolio … these weekly/monthly ranking are a great place to start.

Rolling Market Correlations

All trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results.

Our strategies have not been developed based on knowledge of or with reference to your particular circumstances, such as financial position, goals, risk-reward preferences, tax situation, brokerage arrangement, investment or trading experience, and so forth. Hence no content or model published here constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal financial situation. More