Weekly Correlation Charts: Paris CAC-40 (FCH)

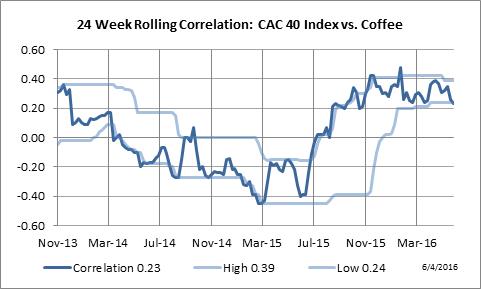

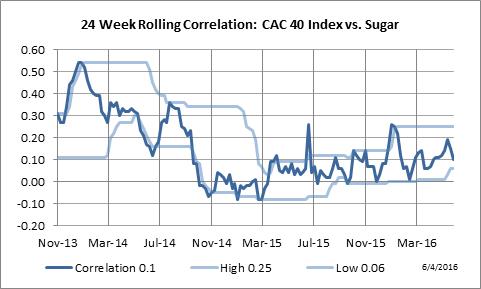

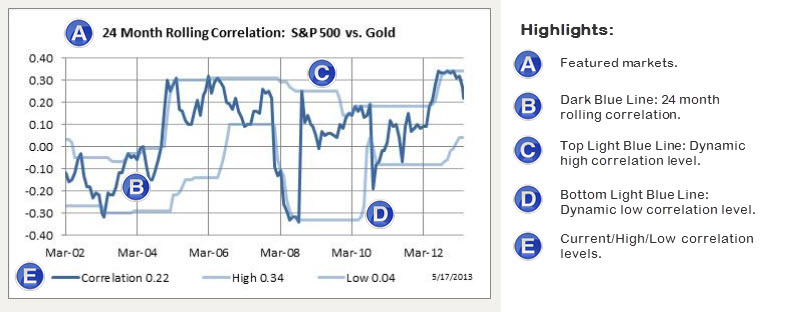

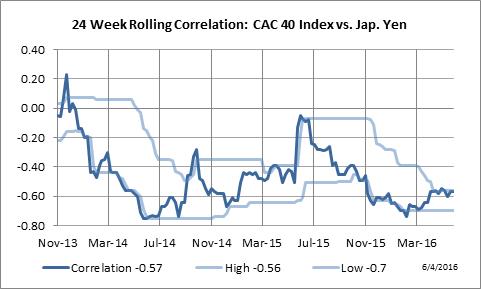

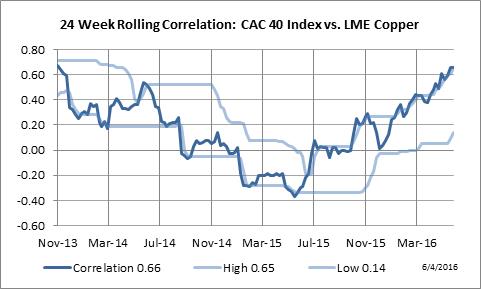

It’s all about the charts … and we have a lot of them. Our correlation charts provide a historic rolling perspective on the relationship between the Paris CAC-40 and 40 other markets. The sample chart shown below (Tab 1), illustrates the 24 week rolling correlation, represented as the dark blue line, clearly shows a continually changing relationship between the markets. Sometimes the relationship is strong while at other times it’s weak. The point is … markets move … as such so do their correlations. Thus we need to continually adjust our interpretation as to what is considered to be a high or low correlation level. To assist in this dynamic interpretation, each chart has outer bands of light blue lines (top & bottom) to reflect true high/low correlation levels. Current levels are also posted at the bottom of the chart.

For current correlation charts for the Paris CAC-40 … scroll down to the individual sectors covering a total of forty global futures markets.

Here are a few basics on how to interpret our correlation charts.

• Each correlation study is based on the market’s % weekly return figure and not price.

• The dark blue line plots the 24 week rolling correlation going back 3 years.

• The lighter blue lines plot dynamic high/low correlation levels that adjust to current market conditions.

• A correlation of +1 signifies a direct relationship while a correlation of -1 signifies an inverse relationship.

Current Weekly Correlation Breakdown

With a long list of markets to scroll through this section offers a quick visual of markets that are currently in a high or low correlation stage with the featured market.

Note markets that recently moved into a high or low correlation stage are highlighted at the end of the bar with an “x”.

Note markets that recently moved into a high or low correlation stage are highlighted at the end of the bar with an “x”.

Currency Sector

24 Week Rolling Correlation: Paris CAC-40 vs. Currency markets.

Energy Sector

24 Week Rolling Correlation: Paris CAC-40 vs. Energy markets.

Equity Sector

24 Week Rolling Correlation: Paris CAC-40 vs. Equity markets.

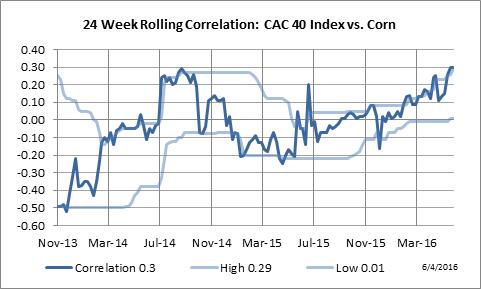

Grain Sector

24 Week Rolling Correlation: Paris CAC-40 vs. Grain markets.

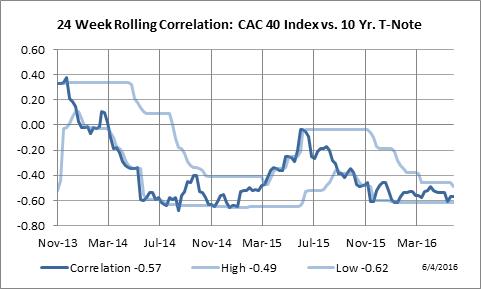

Interest Rate Sector

24 Week Rolling Correlation: Paris CAC-40 vs. Interest Rate markets.

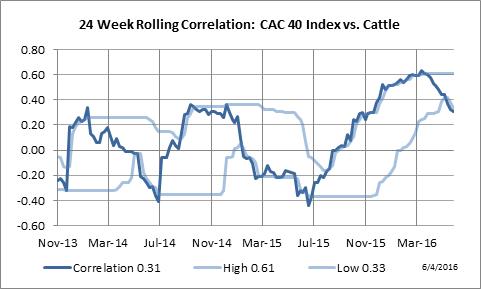

Meat Sector

24 Week Rolling Correlation: Paris CAC-40 vs. Meat markets.

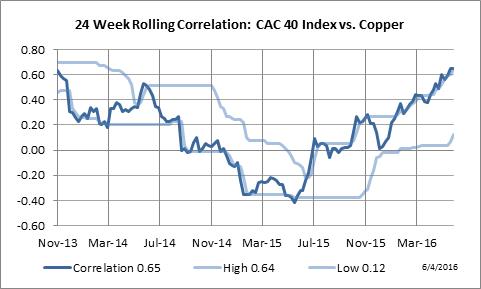

Metal Sector

24 Week Rolling Correlation: Paris CAC-40 vs. Metal markets.

Soft Sector

24 Week Rolling Correlation: Paris CAC-40 vs. Soft markets.