There are no sure trading bets. Markets that are over sold can remain in over sold territory for extended periods (B). Eventually markets do return to normal levels (A). In the case of Submarine Markets they may rise to establish new bullish trends or present new opportunities to short in the near future. The markets on the Submarine list are simply over extended on the downside and in a position to reverse on a short term basis.

How looooooow can they go?

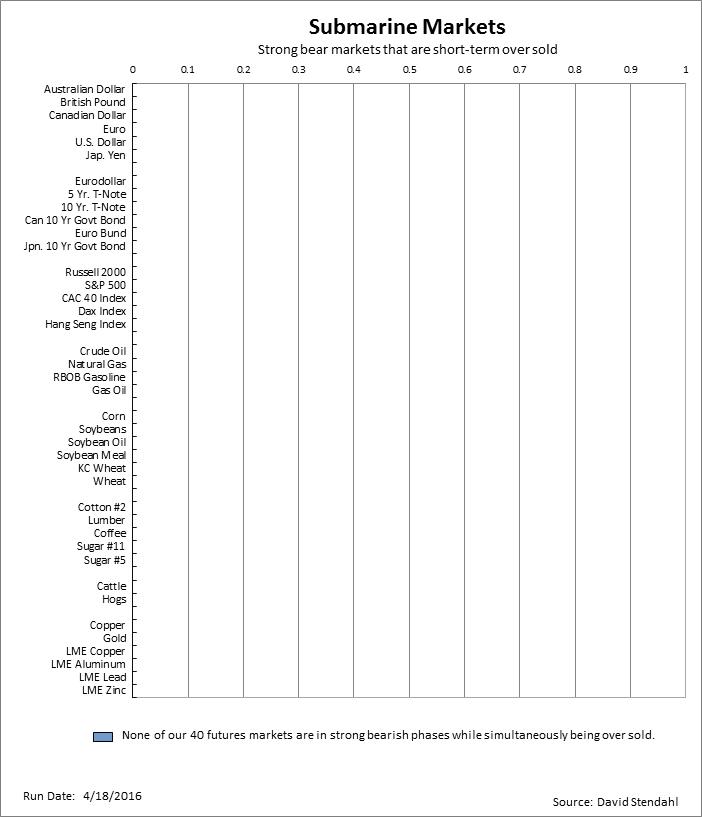

Submarine markets are those that have been falling for awhile but just recently have fallen even further on a short-term basis. No doubt these markets are still in bearish trending phases but they have also moved into over sold territory making them candidates for short side profit taking. Going long these markets is not recommended as their downside trends are still quite strong. If these markets are able to rise from their over sold territory, look for opportunities to reestablish short positions. To assist in finding opportunities, our Hump Market List provides candidate markets that remain in bearish trending phases but that have also risen into short-term overbought territory.

Should these markets continue to fall, look for opportunities to establish short positions. To assist in finding these opportunities, our Hump Market List provides candidate markets that are in established bear trends that have risen to over bought territory.

Submarine Market Definition:

- Bearish trending phase based on our Trend Level indicator.

- Short-term over sold based on our Elastic Level indicator.

Submarine Market: Bearish Trend that are also Strongly Oversold

Our watch list information is strictly provided for educational purposes only. As always … trade at your own risk and analysis.

Additional links worth reviewing:

Check out what the systems are doing

All trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results.

Our strategies have not been developed based on knowledge of or with reference to your particular circumstances, such as financial position, goals, risk-reward preferences, tax situation, brokerage arrangement, investment or trading experience, and so forth. Hence no content or model published here constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal financial situation. More