There are no sure trading bets. Markets that are overbought can continue to remain in overbought territory for extended periods (B). Eventually markets do fall back to normal levels (A). In the case of Hump Markets they fall back to the surface. The markets on the Hump list are simply over extended and in a position to reverse on a short term basis.

Waiting for the other shoe to drop?

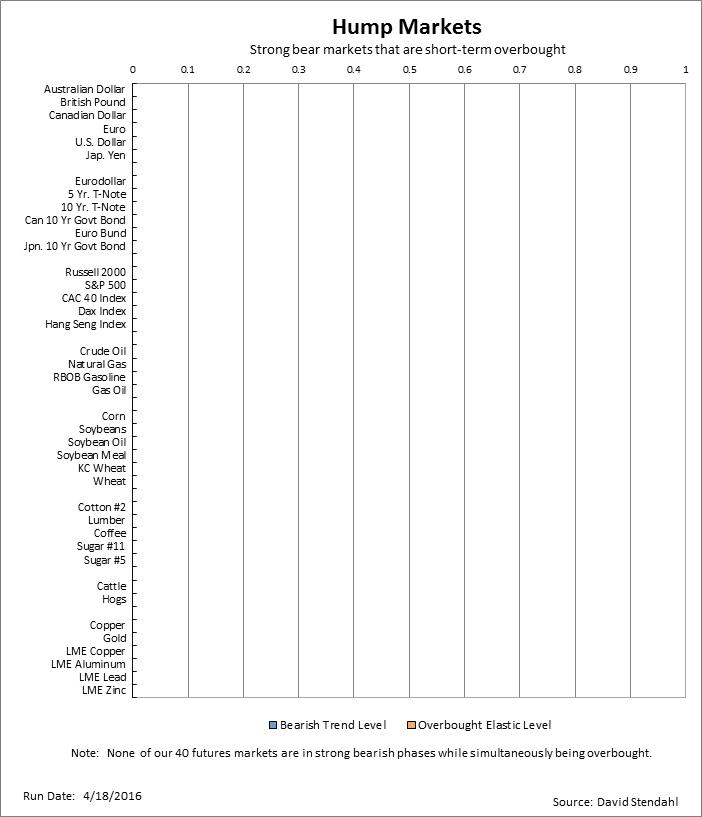

Hump markets are those that have risen to high levels during what is still considered to be a bear phase. Given their recent surge, these markets are at short-term tipping points. If bear trends remain in tact, having these markets in overbought territory makes them sell-on-hump candidates. If however, recent surges help to establish new bull trends then new long candidates are on the horizon down the road. Establishing new longs on these markets now is not recommended as the strength of their trends are still bearish by nature. Take a more wait and see posture. Should these markets continue to rise, look for opportunities to establish long positions. To assist in finding these opportunities, our Dip Market List provides candidate markets that are in established bull trends that have fallen to over sold territory.

Hump Market Definition:

- Bearish trending phase based on our Trend Level indicator.

- Short-term overbought based on our Elastic Level indicator.

Hump Markets: Bearish Trends that are also Strongly Overbought

Our watch list information is strictly provided for educational purposes only. As always … trade at your own risk and analysis.

Additional links worth reviewing:

Check out what the systems are doing

All trading involves risk. Leveraged trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed. The past performance of any trading system or methodology is not necessarily indicative of future results.

Our strategies have not been developed based on knowledge of or with reference to your particular circumstances, such as financial position, goals, risk-reward preferences, tax situation, brokerage arrangement, investment or trading experience, and so forth. Hence no content or model published here constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal financial situation. More