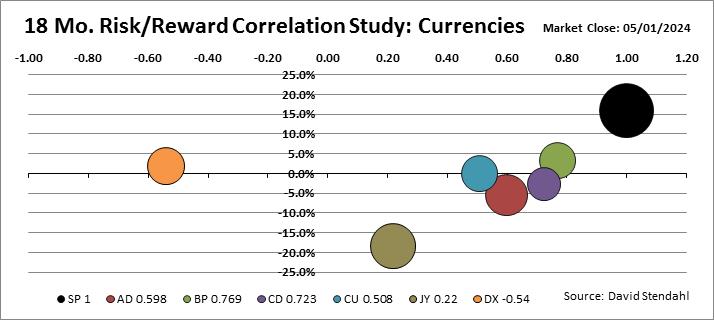

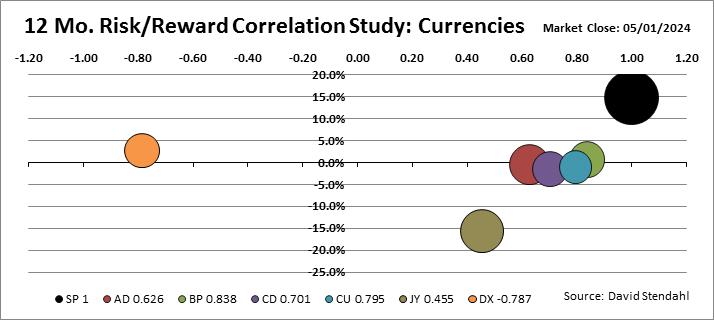

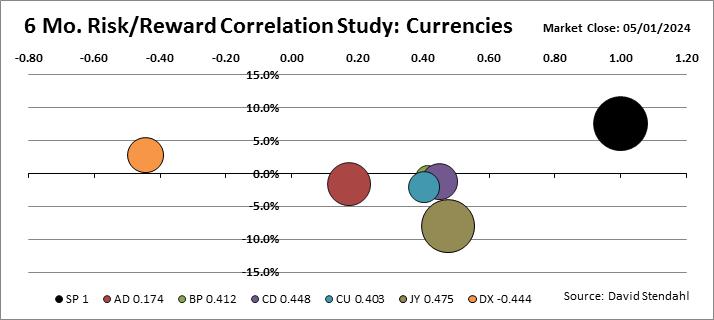

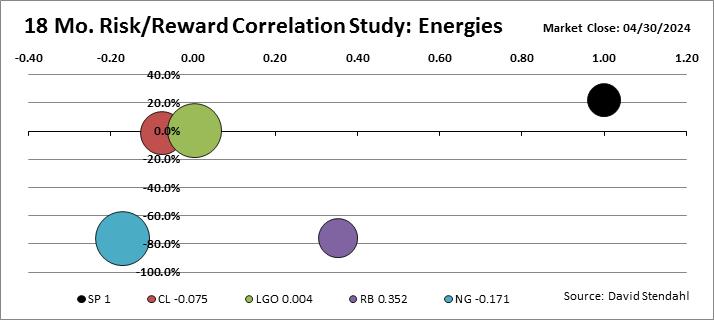

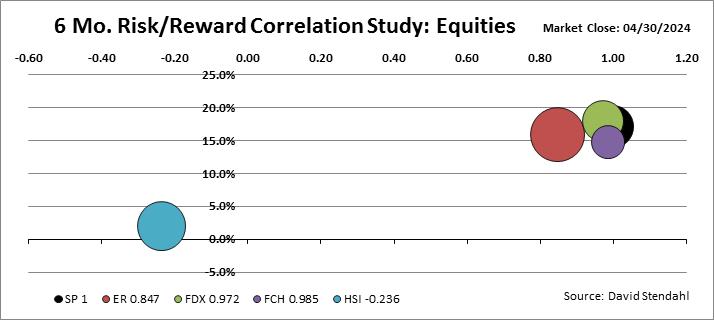

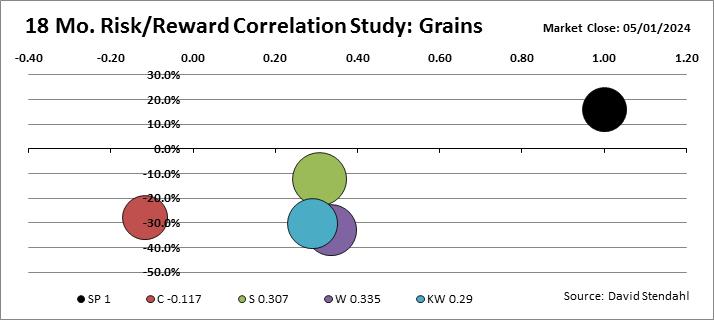

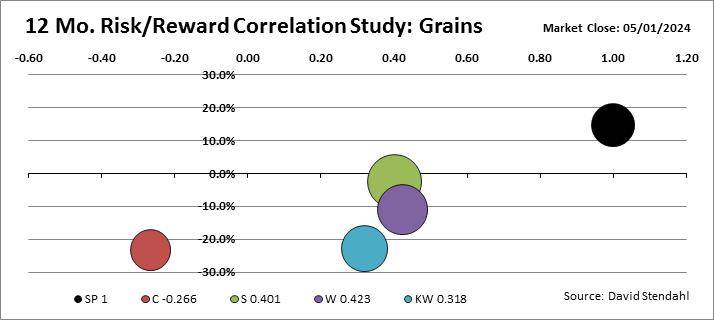

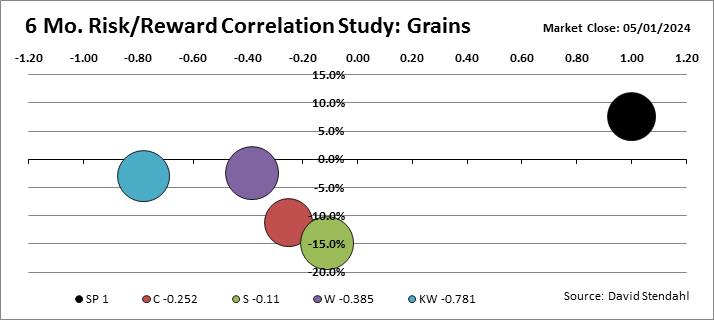

Risk/Reward Bubble Charts: 6/12/18 Month Analysis

How volatile is your market?

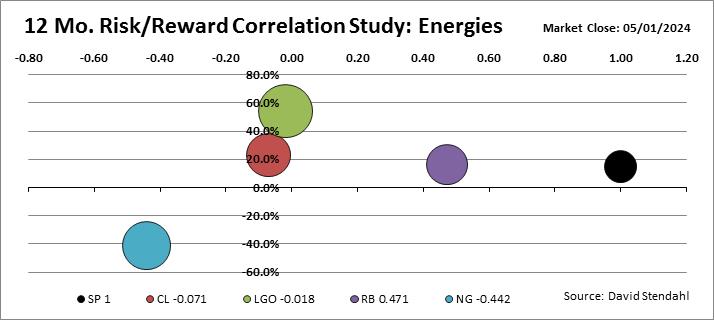

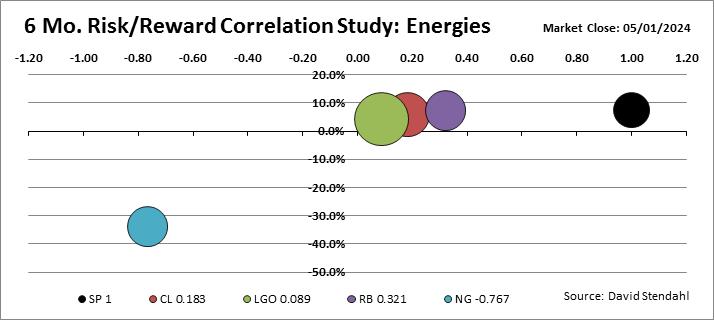

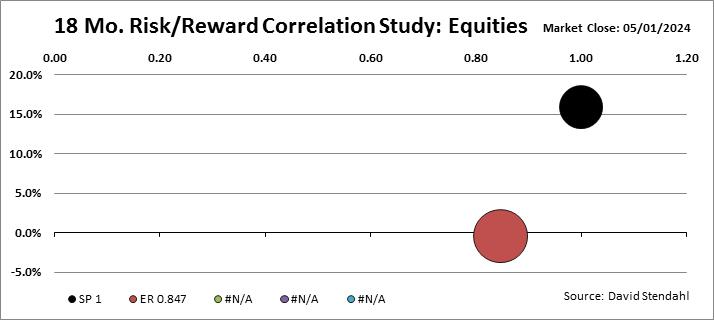

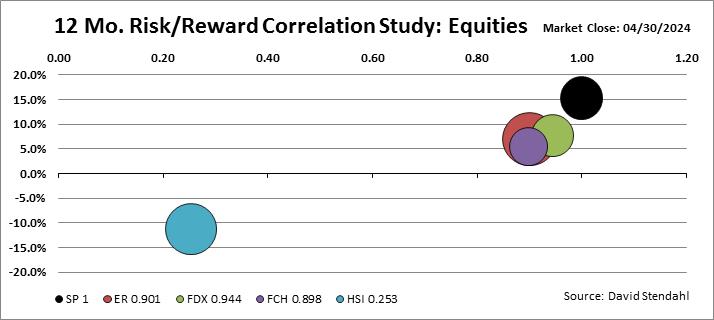

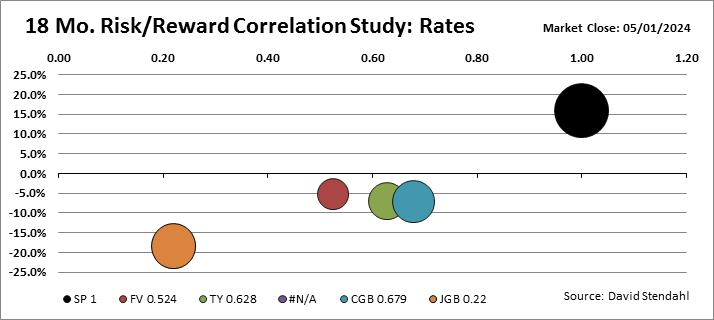

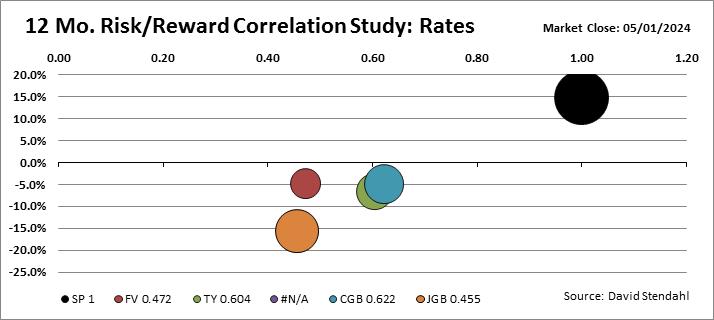

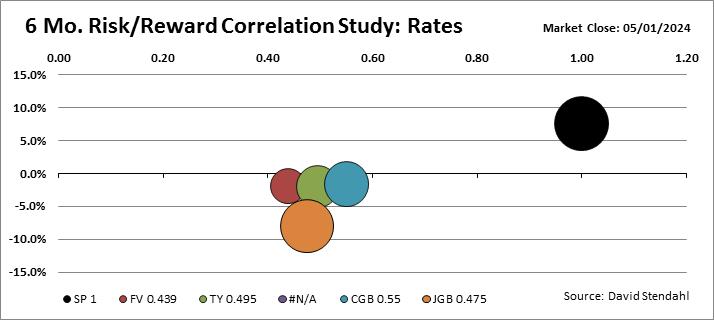

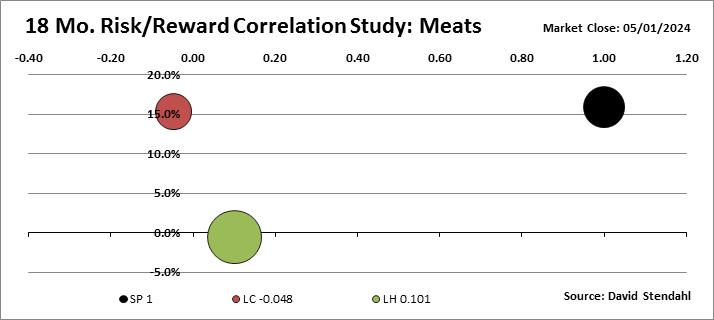

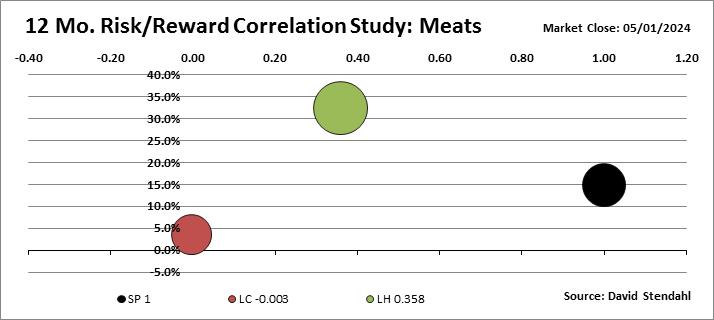

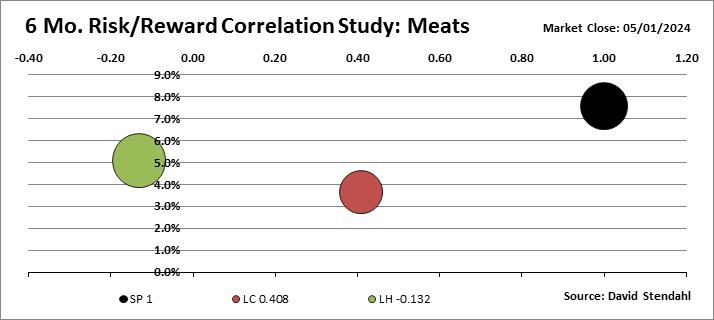

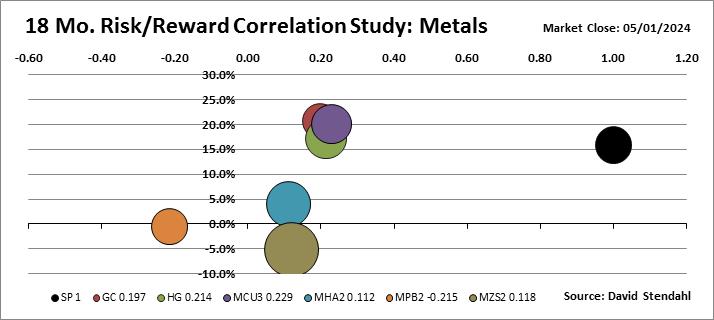

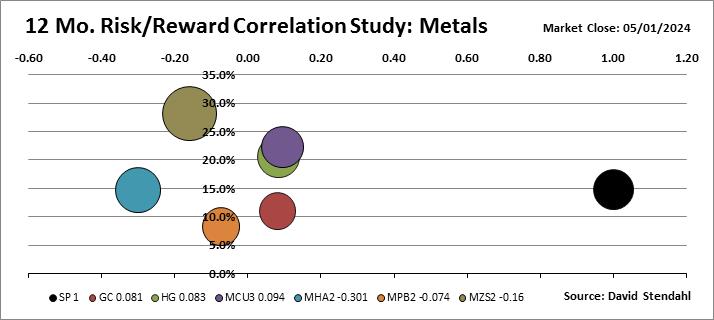

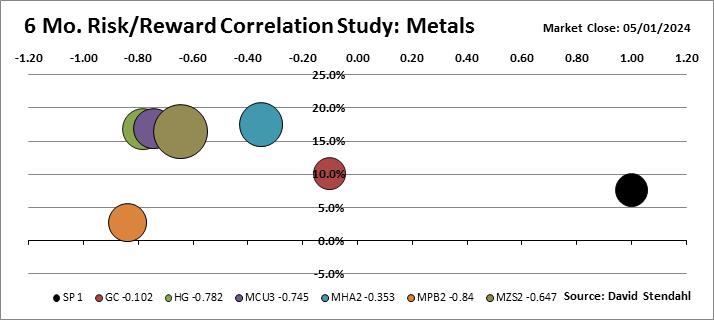

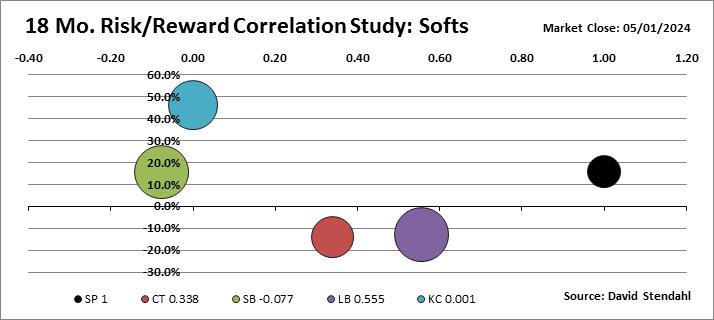

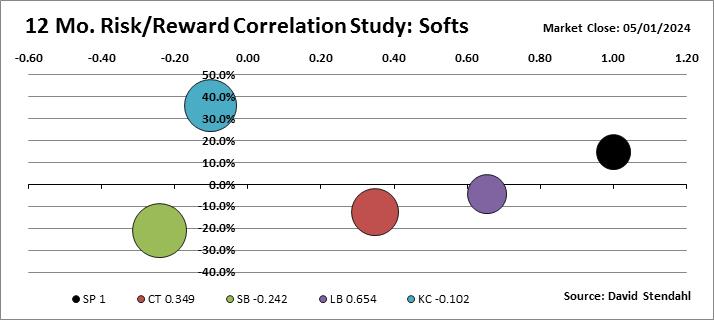

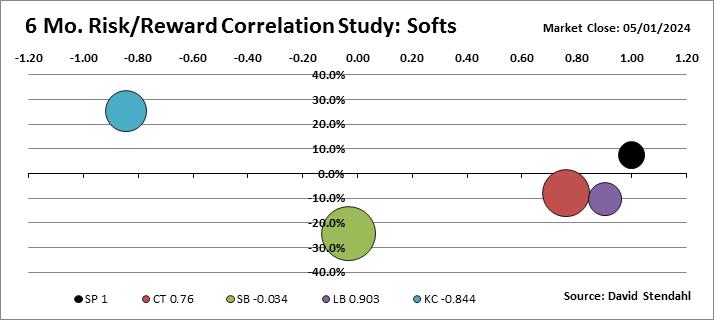

The Risk Reward profiles below are split into eight separate sectors each of which is compared against the S&P 500 Index. The graphic is a simple risk reward scatter chart with a twist that includes market correlation against the S&P 500 Index. Risk (bubble size) is defined as monthly return deviation or volatility … the larger the bubble the greater the risk. Reward (vertical axis) is defined as Compounded Annual Growth Rate or CAGR … the higher the return the greater the reward. Correlation (horizontal axis) is defined as the correlation for each market against the S&P 500 index over the various time periods.

Each sector risk reward profile consists of three bubble charts covering 6/12/18 month snap shots. To view all of the profiles simple click on the right/left arrows to scroll through the various time frames or just let them slowly animate.

Bubble Chart Overview:

- Vertical X-axis = Percent Return

- Horizontal Y-axis = Market Correlation vs the S&P 500

- Bubble Size Z-axis = Daily Standard Deviation of Return (Volatility)

AD: Australian Dollar

BP: British Pound

CD: Canadian Dollar

CU: Euro

DX: U.S. Dollar

JY: Japanese Yen

SP: S&P 500 Index

CL: Crude Oil

LGO: London Gas Oil

RB: RBOB Gasoline

NG: Natural Gas

SP: S&P 500 Index

TF: Russell 2000

FDX: German DAX

FCH: Paris CAC-40

HSI: Hang Seng

SP: S&P 500 Index

C: Corn

S: Soybeans

W: Wheat

KW: Kansas City Wheat

FV: Five Year Notes

TY: Ten Year Notes

EBL: Euro Bund

CGB: Canadian Govt Bonds

JGB: Japanese Govt Bond

SP: S&P 500 Index

LC: Live Cattle

LH: Lean Hogs

GC: Gold

HG: Copper

MCU: LME Copper

MHA: LME Aluminum

MPB: LME Lead

MZS: LME Zinc

CT: Cotton

SB: Sugar

LB: Lumber

KC: Coffee