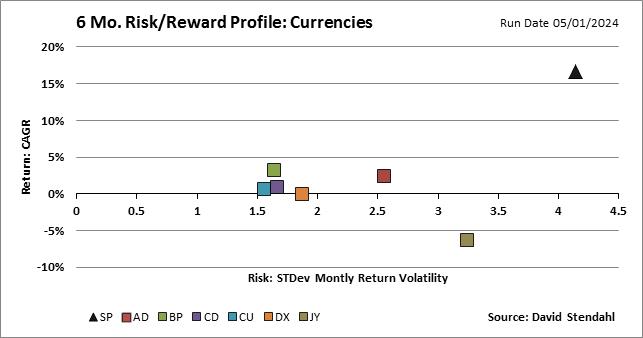

Six Month Risk Reward Profiles

How volatile is your market?

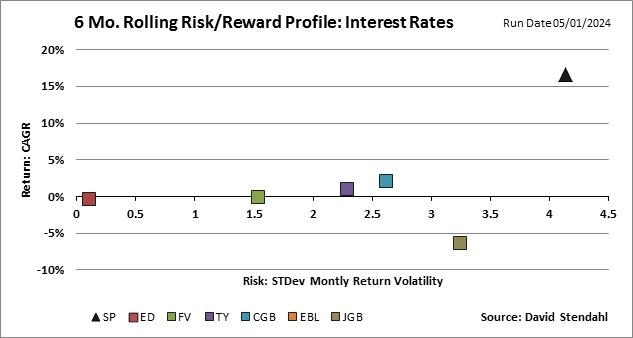

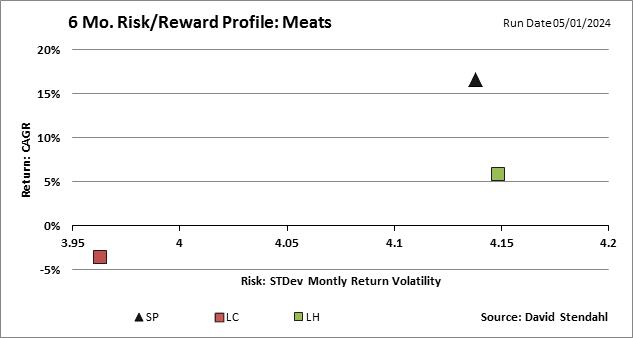

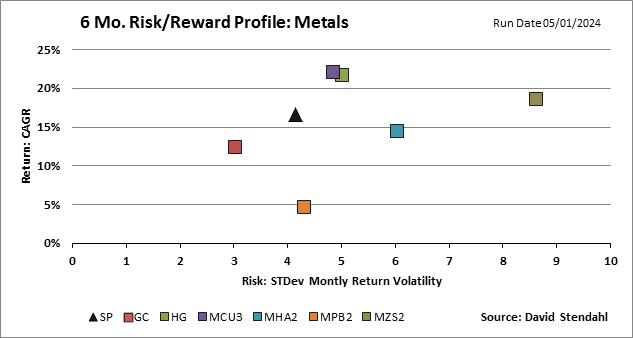

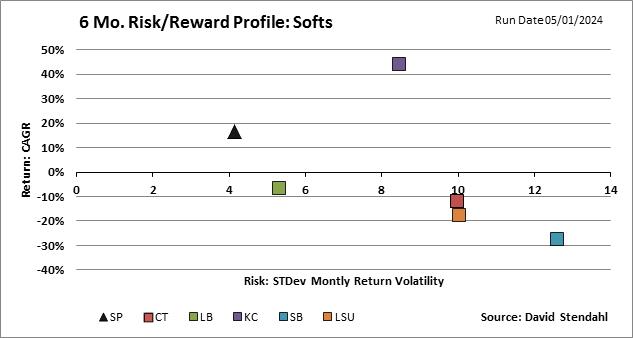

The Risk Reward profiles below are split into eight separate sectors each of which is compared against the S&P 500 Index. The graphic is a simple risk reward scatter chart with risk on the horizontal axis and reward on the vertical axis. Risk is defined as monthly return deviation or volatility … the further to the right the greater the risk. Reward is defined as Compounded Annual Growth Rate or CAGR … the higher the return the greater the reward. Note that the scales for both risk and reward vary for each sector.

SP: S&P 500 Index

AD: Australian Dollar

BP: British Pound

CD: Canadian Dollar

CU: Euro

DX: U.S. Dollar

JY: Japanese Yen

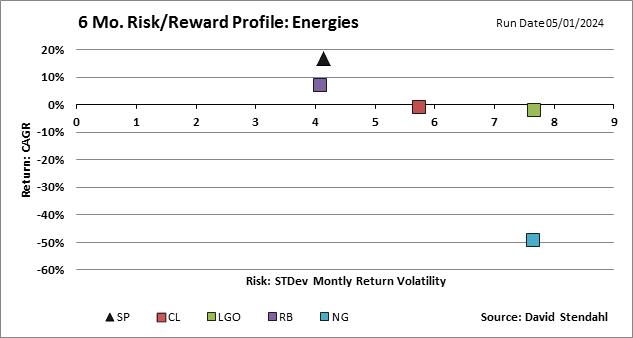

SP: S&P 500 Index

CL: Crude Oil

LGO: London Gas Oil

RB: RBOB Gasoline

NG: Natural Gas

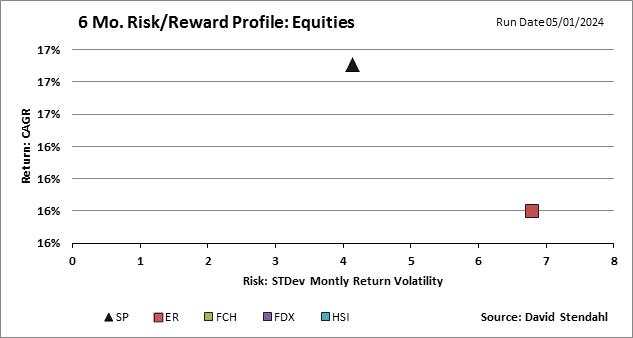

SP: S&P 500 Index

TF: Russell 2000

FDX: German DAX

FCH: Paris CAC-40

HSI: Hang Seng

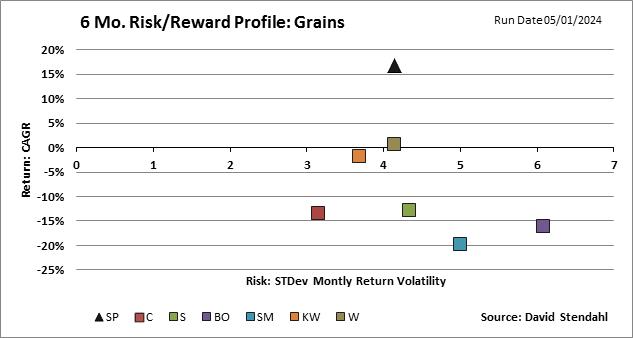

SP: S&P 500 Index

C: Corn

S: Soybeans

W: Wheat

KW: Kansas City Wheat

SP: S&P 500 Index

FV: Five Year Notes

TY: Ten Year Notes

EBL: Euro Bund

CGB: Canadian Govt Bonds

JGB: Japanese Govt Bond

SP: S&P 500 Index

LC: Live Cattle

LH: Lean Hogs

SP: S&P 500 Index

GC: Gold

HG: Copper

MCU: LME Copper

MHA: LME Aluminum

MPB: LME Lead

MZS: LME Zinc

SP: S&P 500 Index

CT: Cotton

SB: Sugar

LB: Lumber

KC: Coffee

Measuring opportunity